The White Label Epidemic of Private Lending

Having direct access to capital is a huge advantage for brokers, until you realize it has nothing to with real success. Success is a result of a fine tuned process and the ability to perform.

Control over your lending process can make or break your business. If you’ve taken out a mortgage, you’ve likely had one of two experiences: a smooth process with clear communication and professionalism, or a frustrating ordeal filled with uncertainty and stress. How can the same loan process produce such drastically different outcomes? The same contrast exists in the Private and Hard Money Lending space.

Over the past decade-plus, there have been massive inflows of capital to the market. What was once a lending space that flew under the radar, with little oversight, fewer regulations, and capital driven by debt funds or mom and pop brokerages, is now a full fledged capital market attracting the likes of Wall Street.

With this change, investors buying residential real estate investments and commercial real estate have largely benefitted. There is no doubt about that. With an influx of capital, cost goes down, leverage goes up, and money is flowing. All is great when the market appreciates in ways we may never see again (think of the 2018 to 2020 Post Covid run up).

When institutional money sees an opportunity, they jump all over it. They’re the best in the business (any business) in identifying that opportunity. However, not every situation turns out peachy. Institutional money is also the best at looking at everything as if it’s a trade in the market and lending is no different. For instance, when COVID-19 sunk its teeth in during March of 2020, institutional investors immediately halted lending. I remember the day clearly, March 12, 2020. DSCR loans at the loan doc stage immediately were put on hold, indefinitely. It took 2-3 months for those capital stacks to return to market. Then they were off to the races again.

Institutional Investors simply needed time to understand the risk and work their loan guidelines accordingly. The shock of it all was that there was no wiggle room.

No lower leverage option. No immediate option to bump the interest. Everything was simply on hold.

This is not consistent with traditional Private Money and Hard Money Lenders.

Fast forward to when interest rates shot up at an unheard of pace and you see similar stalling out in Institutionally Backed DSCR loans, Fix and Flip Loans, Bridge Loans, and Investor Loans. This time around, the issue was pricing.

What rate should we quote today, as a provider of these loans, to be able to sell the tranche on the secondary market?

It seemed as though rates were moving too quickly to confidently price out a loan for those “Lending Companies” to get the loan off their balance sheet post-closing.

I say all this to paint a picture that when it’s good, everything is good. When it’s bad, Institutional Investors simply flip the switch to “off” to gauge the risk. This is a privilege they have because they are diversified across industries.

For those who work, live, and breathe the real estate investment space, we do not have that luxury. Our pivots need to be quick. Our businesses need to continue to run. We do not have the luxury to halt loans and take a wait and see approach. At least not to the extent that Institutional Investors have.

The White Label Epidemic of Private Lending is alive and kicking.

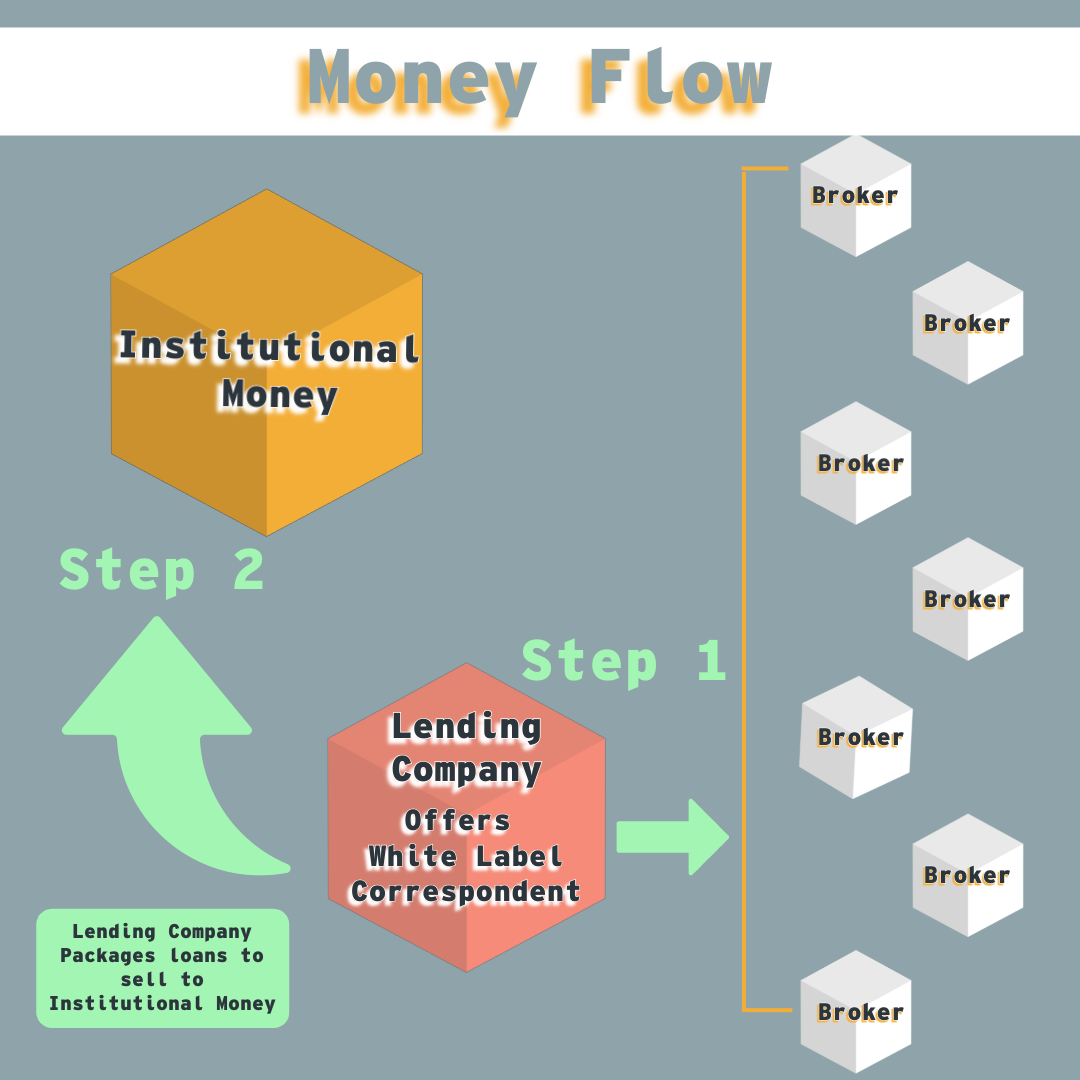

What does White Label or Correspondent agreement mean? This mechanism is fairly new in the Private Lending and Hard Money Lending space. Originally, a start-up company, we will call this the “Lending Company”, would raise money to get their business liquid enough to start funding loans to real estate investors. Their business model is to carry these loans on their balance sheet for a short duration of time. At this point, they have already identified Institutional Investors who are interested in purchasing the loans they funded. After funding a number of these investor loans, the “Lending Company” will sell off tranches of these loans to the “Institutional Investors”.

The issue that “Lending Companies” have is similar to every mortgage broker at every level of lending. How do we penetrate the market? How do we scale this product? “Lending Companies” approach mortgage brokers and real estate brokers to offer their loan products as an option to the real estate investors that the brokers are working with. In California, you can fund business purpose investment loans with a CA DRE license (or CFL). You’re not required to have an NMLS as the loan is specifically, and strictly a business purpose loan. This works perfectly for your local investors who buy fix and flip properties, and rental properties, and had a huge effect on the Short Term Rental property markets.

Effectively, “Lending Companies” were able to market their product to Mortgage Brokers and CA DRE Brokers, widening the scope of who they could do business with. The hurdle that the White Label or Correspondent Agreement addresses is a question that is frequently asked.

Is the borrower working with a direct lending broker, or going through an intermediate broker who shops that deal to other lenders?

In my opinion, this issue is far more scrutinized in the Hard Money Lending space than in the conventional homeowner loan space.

The work around is a White Label or Correspondent Agreement.

The Lending Company offers to “White Label” docs in the broker’s name. Loan documents, disclosures in some cases, and even marketing pieces will appear as though the broker handling the loan, is working directly with the investors. AKA it’s “their money”. The truth is they are not. They are working with the “Lending Company” and the “Lending Company” is adhering to the Institutional Investors buy box.

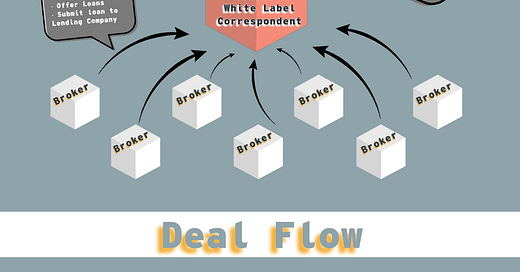

Below is a breakdown of how the deal flow works. In actuality, you will see this is very similar to a Conventional Loan Product, so what’s the big deal?

Process, timeline, and the ability to navigate a transaction on a 10-15 day close becomes completely out of the broker’s hands.

As you see, the scalability relies on the number of Brokers (both Mortgage and CA DRE (or CFL)) that one Lending Company can onboard for their loan offerings. This is one of the driving factors in why you’ve seen a massive influx in the number of people and companies who can add investor loans to their conventional loan business.

Unfortunately, this was also a huge factor when, all of a sudden, in March of 2020 and again when interest rates started running away, most of these lenders no longer offered their investment loans. “As the wind blows”, is the saying we like to have. When mortgage brokers and CA DRE brokers have the wind at their backs, they're all in. When the headwinds start rolling in, they disappear. Then they come back and the cycle continues.

The moral of this story is that the Institutional Investors steer the ship. They control the inflow and outflow of money. They lay out the credit guidelines, ultimately controlling the underwriting conditions, and final approval of a loan. Technically the “Lending Company” will handle this, but they are adhering to the buy box of their end buyer of the paper. Semantics I know.

It’s important to note that the “Lending Company” needs a reason to write the loans they offer. They typically have 2 (or 3) main reasons.

Do we have the ability to sell the loans off our Balance Sheet to Institutional Players?

Can we sell them at a premium?

Can we sell them with a YSP (Yield Spread Premium)?

Bullet points 2 and 2a go hand in hand. During the best of times, with this type of business structure, “Lending Companies” could expect 2-6% premiums on their loans. They lend $100,000 which goes to their balance sheet. Once they package that loan up they receive $102,000 - $106,000 back to lend out again. A nice ROI and ability to Compound their returns in exchange for holding the loan on their balance sheet for a short duration of time. This is a genius business model.

Similarly, when interest rates were suppressed, they could price loans with an interest rate of X and sell the loan off with an interest rate of X (-) the spread. The leftover or arbitrage is the Yield Spread. This generated another source of income for the loans they were writing. Again, quite a genius model.

Choppy waters cause choppy times and when markets get volatile, the premium and YSP becomes a more difficult task to undertake. What was once a +2-6% premium turns into a 4-6% discount. A business model that is built on receiving a 2-6% premium will have trouble when they are now receiving only $94,000 to $96,000 of their original $100,000 loan. As a result, all trains come to a halt. No loans are written. Deals that are expected to close are indefinitely on hold. That is until they can reprice internally and bring a new structure to market.

Below is a breakdown of the money flow. Mainly dependent on Brokers, required to be Funded by the “Lending Company”, and then, bought by Institutional Money.

The Private Lending and Hard Money Lending space has built its name on quick access to money that often competes with all cash offers. This is true in the residential investment space and for CRE bridge loan space. The issue with the above is there are too many points of potential failure. A change in market conditions, a pandemic, and interest rates running away are a few we have experienced. What happens if there is international conflict, a negative movement in the stock market, or political strife? There’s an infinite amount of scenarios that can jeopardize the ability to perform.

The White Label Epidemic is one of representation. Outside of walking into your local bank branch and obtaining a loan from your bank, rarely does a Conventional Mortgage Broker present their options as if they are working with their own capital. A White Label or Correspondent Agreement does just that.

Clients and borrowers are putting their trust in professionals to have clear and open communication. Oftentimes, that is not the case when working with White Label loan programs.

How do we adjust in today’s market? Understanding the back end of what is happening. There are plenty of lenders who are direct to the capital. Debt Funds and Traditional Trust Deed Investor Brokers are a few you can call on. One simple question you can ask or consider is, “Are you a Private Money or Hard Money Lender or do you offer Private/Hard Money in addition to your conventional loan business?” The answer should tell you all you need to know.

If you’re a Mortgage Broker or CA DRE Broker offering Private Money or Hard Money Loans, you can see these changes with your own eyes. The rebranding of the industry to include “Residential Transition Loans” or RTLs as an option is just that, rebranding. Institutional Investors don’t like the idea of funding Hard Money Loans so they slap a new name on it and pretend.

The fact of the matter is that Institutional Investors also have minimal credit requirements, they are also asset based in nature and are also offering very similar rates and fees.

Another issue on which Mortgage Brokers and CA DRE Brokers should keep a careful eye is the ability of the “Lending Company” to originate their own loans. As you can imagine, these “Lending Companies” have quite the backing and impressive marketing budgets. At a click of the mouse and the submission of a loan, your client’s information is in the hands of that company. Miraculously, their information can be, and will be popping up on borrowers’ feeds with advertisements from the “Lending Company.” It may not be direct but a branch of the parent company funding the “Lending Company”. This happens all the time. The data is not safe from purging.

We have seen the write ups for White Label and Correspondent Agreements and the “promise” to not work directly with clients is as loosely written as a freshly used tissue. Who can blame them though? They have a product, want to take market share, gather all the borrower’s information to underwrite the file, and need contact information to service the loan. If you, as a broker, have an issue with it, you get to call one of their many departments to raise your concerns.

The Epidemic affects everyone in the space. My goal is not to steer you away from utilizing some of the amazing access to capital that is out there. My goal is to inform you so there is more transparency in the market. Use it at your discretion.

You will win your clients with process, communication, and their trust/belief that you will close the loan as intended. It rarely has to do with if your name is on loan documents. No one is perfect. No process is perfect, but we should all agree that we can do better for our clients by being transparent with what we’re offering.

If you enjoy this article, please hit the subscribe button. Each week, I will continue to provide details from a Lender’s perspective about the Industry that is known as, Private Money Lending, Hard Money Lending, Asset-Based Lending, etc.